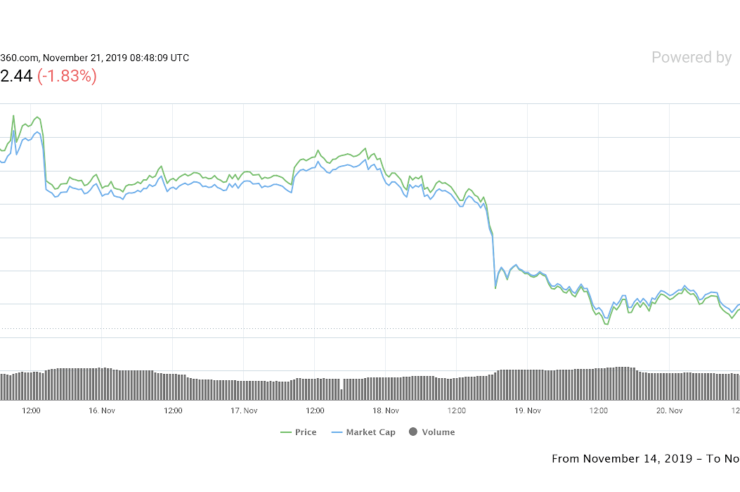

Bitcoin (BTC) fell below $8,000 on Nov. 21 after several days of downward price pressure finally cost the cryptocurrency a major support level.

Data from Coin360 showed BTC/USD finally reentering the $7,000 range on Thursday, marking its lowest since the last week of October. $7,880 was met by an immediate bounce to $7,940.

Bitcoin daily price chart. Source: Coin360

Analysts eye $7,500 and $6,500 floors for BTC

Analysts had widely predicted the bearish move, with regular Cointelegraph contributor Michaël van de Poppe recently eyeing $7,400 as a realistic new support zone for Bitcoin.

Continuing the forecast, fellow contributor filbfilb highlighted even lower levels — $6,500 or the pivotal profitability price for miners — as the ultimate floor if bearish sentiment continued. Before that, the 100-week moving average (WMA) at $7,520 could provide further support.

As Cointelegraph reported, $6,500 is considered by many commentators as the lowest possible Bitcoin price under current conditions.

“Still think the 100 WMA will hold up at this stage, but if it doesn’t, I’m all in at $6,500,” filbfilb said in private comments.

On Monday, statistician Willy Woo forecast that current Bitcoin price behavior would remain “unique” compared to previous cycles in its history. Specifically, BTC/USD would approach its 2020 block reward halving on bearish sentiment. In 2012 and 2016, halvings followed at least six months of bullish progress.

Woo additionally predicted that volatility would remain a feature for Bitcoin in the coming months.

Comments (No)